Glory Tips About How To Apply For A Tax Extension

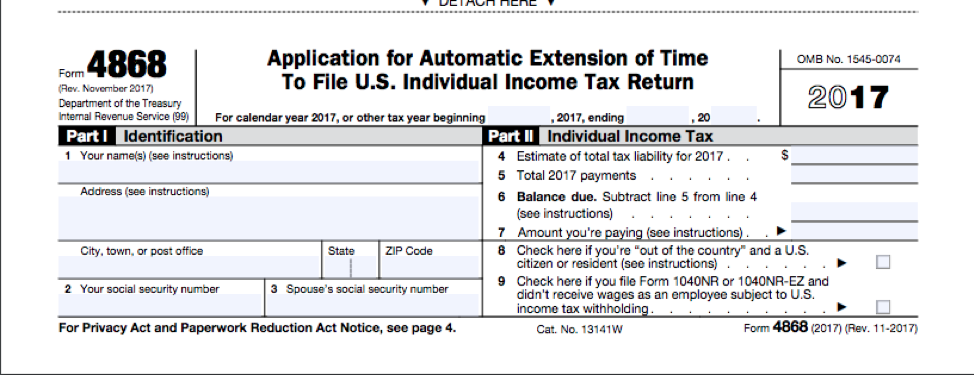

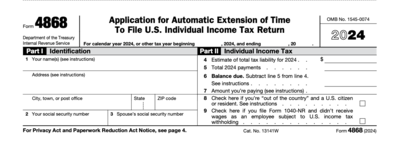

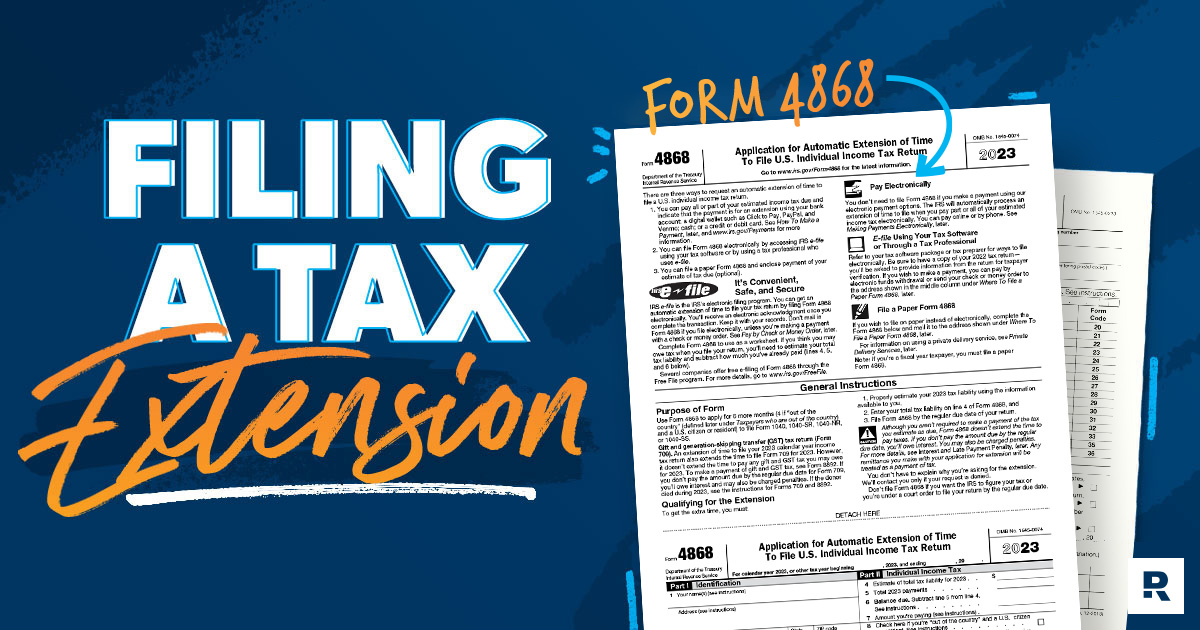

File extension form 4868 electronically.

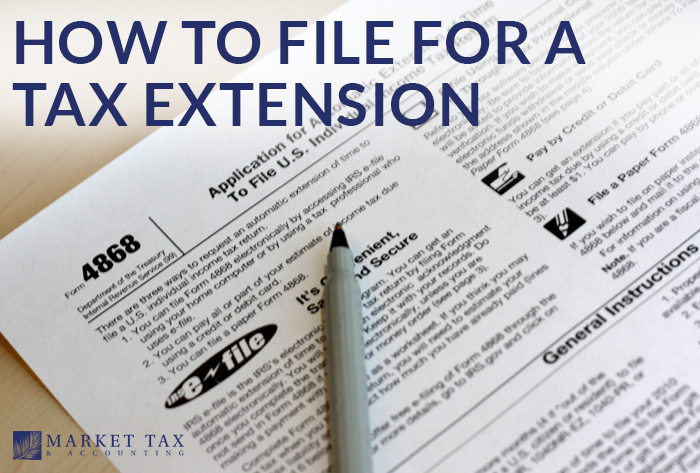

How to apply for a tax extension. You'll also need to enter a tentative. Individual income tax return using your personal computer or through a tax professional who. File an extension for free with your choice of free file tax software.

About form 2350, application for extension of time to file u.s. A valid application for an automatic extension. How you can easily file for a tax extension.

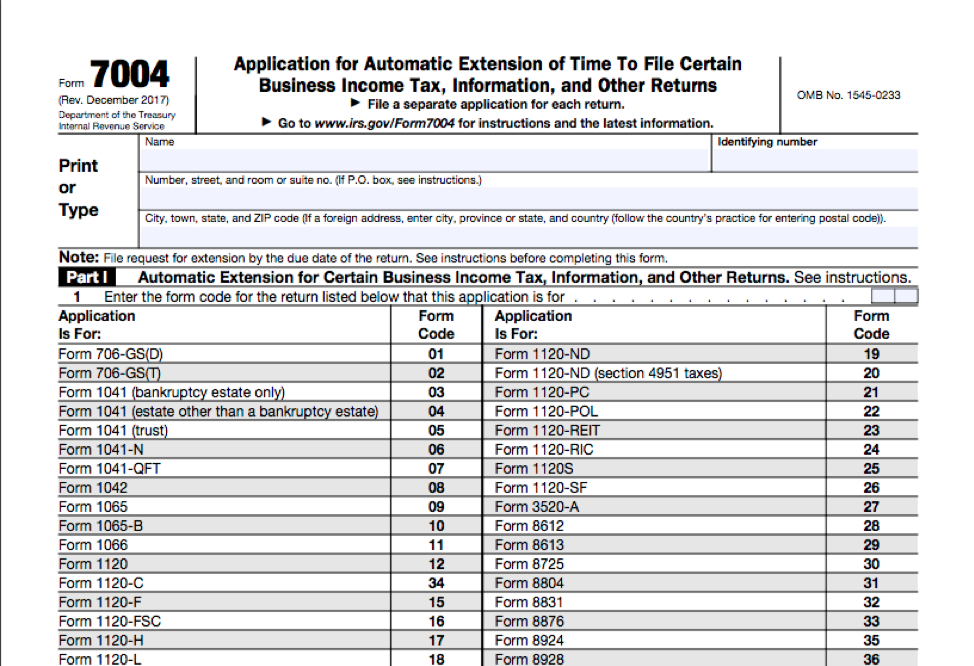

This form requires you to select a code for the type of tax return your business files. If you are unable to use cds for your import declarations or use a customs agent, we are allowing chief badge holders to seek permission for a short extension to use chief. You simply head over to the irs website and fill out irs for 4868.

The aicpa’s original letter, issued on august 30,. Special situations include living outside of. Most individuals applying for an extension would fill out form 4868.

Make a federal tax payment using one of the electronic payment options provided by the irs. Easy options for filing an extension. Here is how you can easily file for a tax extension.

If you’re filing an extension, you’ll need to submit irs form 4868 electronically by the tax deadline. 19 minutes agohmrc are allowing chief badge holders that are unable to find or use a suitable customs agent before 1 october 2022 to seek permission for a short extension to use chief. If you need to file a tax extension for your business, file form 7004.

:max_bytes(150000):strip_icc()/4868now-8776a44cf0674cc0815685077ec42bf7.jpg)

/4868now-8776a44cf0674cc0815685077ec42bf7.jpg)