Stunning Info About How To Appeal Property Taxes In Nj

Here is a step by step process for understanding how to save on your property taxes.

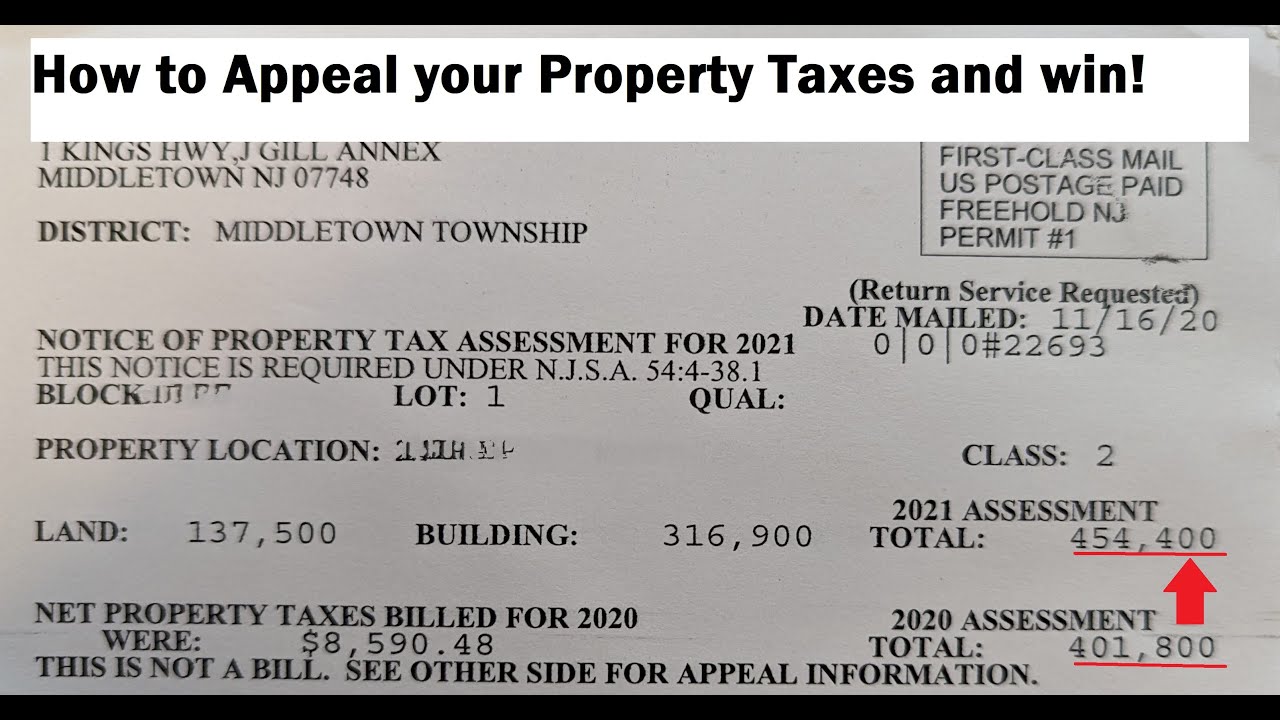

How to appeal property taxes in nj. Request your property tax card your property tax card is located in the town hall. Our mission is to facilitate secured and efficient electronic filing and management of property assessment. Ad real estate lawyer $345 ***lowest legal fees***.

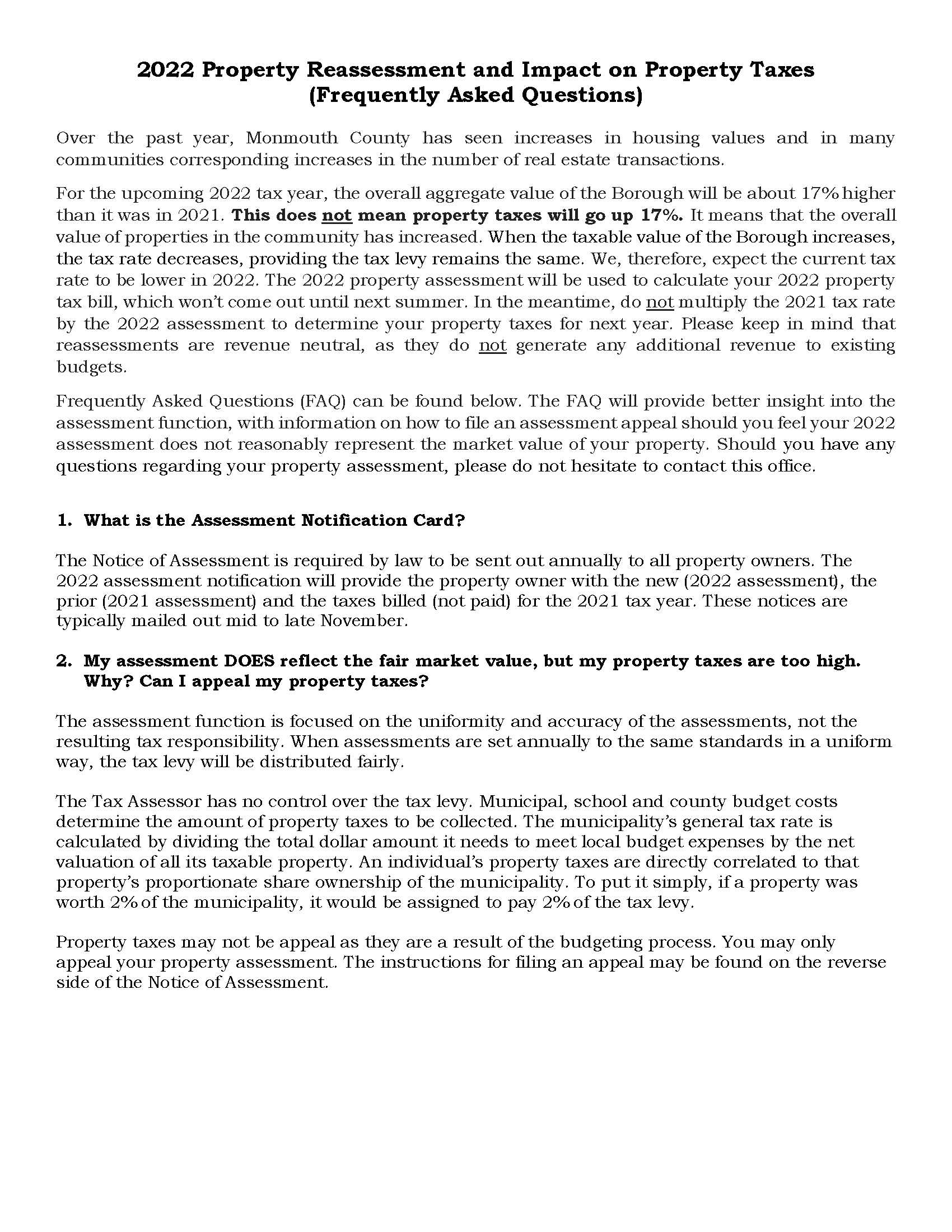

As soon as you receive your proposed property tax. Nj property tax appeal 28 kenneth place clark, nj 07066 tel: Remember your home’s value determines the taxes on your home.

If you are dissatisfied with the judgment of the bergen. File your appeal with tax court. File your appeal within 30 days after receiving your reassessment notice.

Tax appeals must be timely filed on/or before april 1 (december 1 for added or omitted assessments) of the tax year; Basics of tax appeals in new. Property tax appeal procedures vary from jurisdiction to jurisdiction.

File your appeal with tax court within. A guide to tax appeal hearings; If you are not satisfied with the decision made at your county tax board hearing, you can file an appeal with the tax court of new jersey.

If you miss the deadline, you’ll have to wait until the following year to file an appeal. Check your property tax assessor’s website. If you are not satisfied with the decision made at your county tax board hearing, you can file an appeal with the tax court of new jersey.